Table of Content

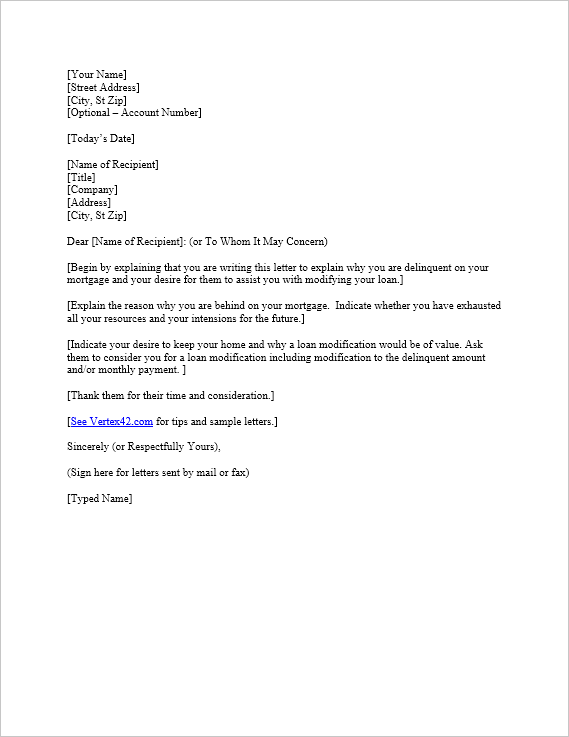

If you’ve had trouble paying your mortgage on time on a consistent basis, you may end up with a foreclosure or a deed-in-lieu of foreclosure. That means that your lender takes back your house and then sell it to redeem at least some of the money that you owe them. If you have property you want to keep, you may instead consider a Chapter 13 bankruptcy. This means that instead of having to liquidate your property, you are given a repayment plan that will allow you to repay debts over three to five years. The home you wish to finance using Section 502 direct loans must meet certain requirements, including cost. Because home values vary widely by geography, each county has its own price limit for purchases made using Section 502 loans.

Department of Agriculture - Farm Service Agency have properties listed on this site. For additional information regarding the purchase requirements to buy these properties, please reference the How to Buy link. You need to have a lender pull a CAIVRS report when you apply for a pre-approval.

Chapter 7 Bankruptcy and USDA Loans

The VA treats foreclosures similar to bankruptcies as well at least one year of good credit is required for a VA loan eligibility. Similar to FHA loans, extenuating circumstances are allowed for reasons “beyond the control” of the borrower if properly documented. The VA treats foreclosures similar to bankruptcies as well — at least one year of good credit is required for a VA loan eligibility. USDALoans.com is a product of ICB Solutions, a division of Neighbors Bank.

Nearly three million properties received foreclosure filings in 2010 — a record for the American housing market. Homeowners may experience foreclosure because of various reasons, including extenuating circumstance such as serious illness or death of a wage earner, which cause them to default on payments. Others may experience financial distress after a divorce or job loss. Foreclosure is detrimental to a borrower’s credit, making it difficult to acquire financing soon after, even with a cosigner. Similar to FHA loans, extenuating circumstances are allowed for reasons beyond the control of the borrower if properly documented.

Getting A Usda Mortgage After Bankruptcy Chapter 7

USDA Rural Development Guaranteed loans provide lucrative financing for families that fall into the low income bracket for their area. It is a great way to get a low rate and flexible qualification guidelines. The one caveat to the USDA RD loan program is that you must purchase or live in a home in a eligible rural area. The USDA determines the areas considered rural for their loan program and the data changes periodically.

Like with bankruptcy, a foreclosure can negatively affect your credit. But it’s possible to still get a USDA loan after a foreclosure – typically three years after the recorded date of the foreclosure. In order for a property to be eligible for a USDA loan, the home must be located in a rural area. Creating a relative or friend co-sign on new credit lines can also help you be considered easier and begin building brand-new credit score rating. While it is possible to get a mortgage after bankruptcy, it can be quite challenging.

Buying A Home After Foreclosure

Loan proceeds may be used to purchase, renovate or relocate a home, or to make site improvements including installation of water and sewage services. Lenders may view your application as risky since youve demonstrated your inability to pay back your debts in the past. Once you find a lender willing to provide you with a loan, make sure youre able to repay it in order to avoid falling into a debt spiral again.

The late payments and eventual foreclosure causes serious damage to credit scores. Yet, below it will show that with a little time and new credit, buying again is possible. Foreclosures and alternatives like a deed-in-lieu of foreclosure or a short sale will all negatively impact your credit score, but you will still be able to purchase real estate. You will probably need to wait a certain amount of time before a mortgage loan servicer will even consider giving you a mortgage. The length of time youâll have to wait will depend on the loan servicer and the kind of loan that youâre seeking.

By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Neither Mortgage Research Center nor ICB Solutions guarantees that you will be eligible for a loan through the USDA loan program. USDALoans.com will not charge, seek or accept fees of any kind from you. Mortgage products are not offered directly on the USDALoans.com website and if you are connected to a lender through USDALoans.com, specific terms and conditions from that lender will apply.

A foreclosure on a home occurs when a homeowner does not pay their mortgage. If youre unable to pay off your home loans, then your home may be entered into a foreclosure auction. Just keep in mind that there is no one-size-fits-all when it comes to lenders dealing with this situation, says Rodriguez. Every lender has different requirements aside from basic guidelines set down by the FHA, VA, USDA, Fannie Mae, and Freddie Mac. The USDA Customer Service Center recently received reports of customers being contacted by someone claiming to be a CSC representative offering a special rate to bring delinquent accounts current for a fee. The caller asks the fee be paid by use of a prepaid credit card or other methods of payment that are difficult to stop or track.

Keep in mind that if you’re putting less than 20% down, you’ll be required to get private mortgage insurance . Check with your lender early in the process on how the PMI company views foreclosures. In many cases, PMI companies impose stricter standards than Fannie Mae or Freddie Mac. If the loan that you had to give up had a USDA loan on it – it is unlikely you will be eligible for another USDA Loan.

Some states do not allow collections on payments made by lenders after a foreclosure. The waiting period after foreclosure is two years for a VA loan with proof of re-established credit. Second, understand the implications of credit-related decisions before opening, closing, or asking for a boost to your available balance. For example, don’t close any credit card accounts in an attempt to raise your score. This tactic usually backfires because having fewer open accounts can lower your credit score.